dependent care fsa rules 2021

The CAA provides flexibility for unused amounts in health and dependent care FSAs for 2020 and 2021 among other changes. ARPA automatically sunsets the increased dependent care FSA limit at the.

Dependent Care Benefits Overview Criteria Types

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

. Dependent Care FSA Increase Guidance. A family using an FSA to cover qualifying expenses can save thousands of dollars every year with little downside. Because of the American Rescue Plan signed into law in March 2021 the contribution limit has been raised to 5500 for married couples filing jointly or 2750 for an individual or married person filing separately.

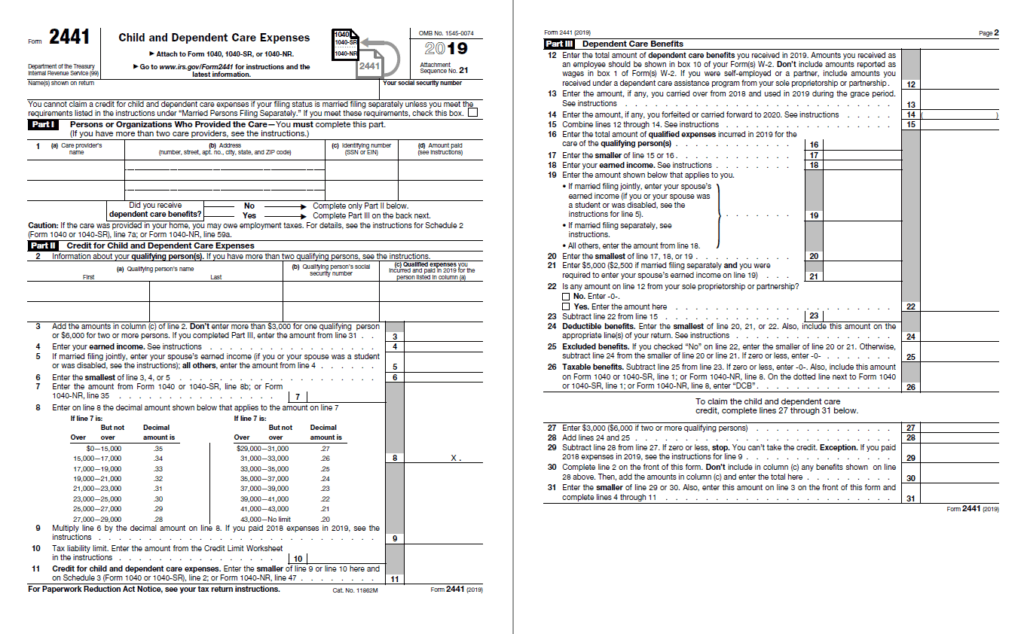

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. Parents and caregivers can use funds in this type of account to pay child care or elder daycare bills. Your employer will also include in your wages shown in box 1 of your Form W-2 any dependent care benefits that exceed the maximum amount of dependent care benefits allowed to be excluded for 2021.

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. If you have a stay-at-home parent in your household you are not eligible for a Child Care Dependent Care FSA. The limit will return to 5000 for 2022.

The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year. For married couples filing joint tax. ARPA Dependent Care FSA Increase Overview.

A Child Care Dependent Care FSA allows you to pay for certified day care pre-school and elder care needed by eligible children under age 13 or aging parents. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately.

The limit is expected to go back to 5000. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in programs that test the boundaries of IRS eligibility. 1 The FSA changes were designed to help participants with.

There is no dollar limit on the amount that can be carried over. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time. The most money in 2021 you can stash inside of a dependent-care FSA is 10500.

If you are married and filing separately you may contribute up to 2500 per year per parent. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products.

Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only. Health and Dependent Care FSA Carryover. Dependent Care FSA Eligible Expenses.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. September 16 2021 by Kevin Haney. September 17 2021.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. For 2021 the ARP increased to 10500 previously 5000 the maximum amount that can be excluded from an employees income through a dependent care assistance. Double check your employers policies.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. It also increases the value of the dependent care tax credit for 2021. If a child turned 13 in the 2020 plan year AND the participant rolled over funds into.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. If you have a dependent care FSA pay special attention to the limit change. If you are divorced only the custodial parent may use a dependent-care FSA.

Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single taxpayers and married.

Dependent Care FSA. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

The Internal Revenue Service has issued Notice 2021-15 clarifying the flexible spending account FSA provisions of the Consolidated Appropriations Act 2021 CAA. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to. If you have one child and spent over 8000 for their care in 2021 you can still take advantage of 3000 of expenses 8000 childcare expense limit minus the 5000 of expenses you have already.

For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent. Under the American Rescue Plan Act of 2021 the exclusion for employer-provided dependent care assistance has been increased from 5000 to 10500 from 2500 to 5250 in the case of a separate return filed by a married individual for 2021. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

This was part of the American Rescue Plan. Your employer may elect a lower contribution limit. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck.

Employers can choose whether to adopt the increase or not. Dependent care FSA increase to 10500 annual limit for 2021. As more companies adopt the FSA.

On January 14 2021 the Health Service Board approved the following three changes to. However if you did not find a job and have no earned income for the year your dependent care costs are not eligible.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Flexible Spending Accounts Flex Made Easy

Dependent Care Fsa Dcfsa Optum Financial

2021 Changes To Dependent Care Fsas And What To Know

How A Dependent Care Fsa Can Enhance Your Benefits Package

Dependent Care Flexible Spending Account

Why You Should Consider A Dependent Care Fsa

Child Care Tax Savings 2021 Curious And Calculated

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child And Dependent Care Expenses Credit Youtube

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is A Dependent Care Fsa Wex Inc

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System